Before we get into this writeup I think it’s worth establishing my history with the shipping industry. During 2021 a younger and far less experienced Myles was just starting to get into investing. At some point I stumbled across a thread on Twitter detailing the drama that was going on within the container shipping industry due to Covid. The next weeks were spent going down a rabbit hole that resulted in a bit of money being made over the following 6 months on containers, and a ton of money lost in dry bulk and tankers (which sadly I quit a month before the Ukraine war started and those sectors mooned). The other result of this rabbit hole was a general obsession with the shipping industry as a whole, along with a solid (better than generalist, but by no means expert) understanding of shipping economics. It was to my delight then earlier this year that I stumbled upon Singapore Shipping Corp as an idea. While initially I thought it more as a speculative play on the pure car, truck carrier (PCTC) car carrying sector, as I’ve dug deeper recently I have built some serious conviction and think it’s worth writing out in a bit more detail than my previous short twitter thread on it.

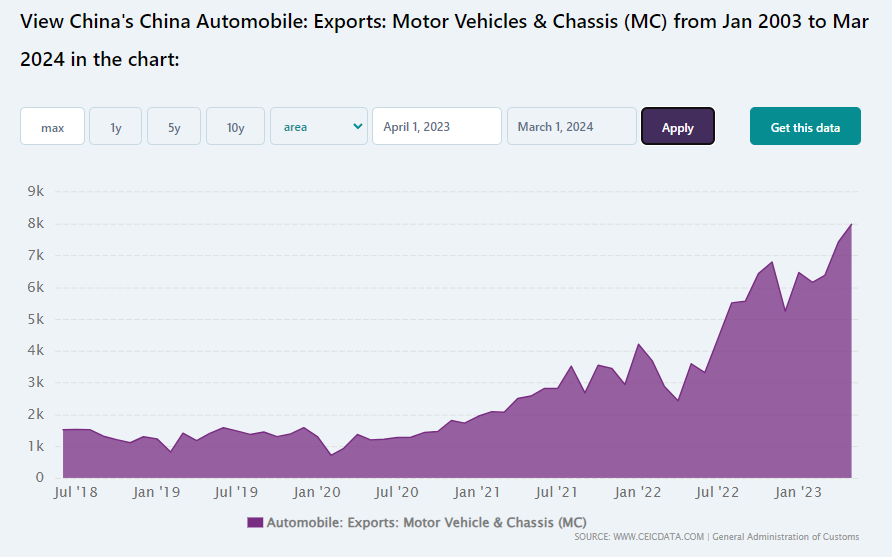

First let’s start off with some context on the fascinating state of the car carrier shipping sector. Similarly to the rest of shipping, car carrier rates peaked in the late 2000’s before entering a decade of weakness. Unlike the rest of shipping however, car carriers didn’t see a recovery during covid as chip shortages resulted in an undersupply of vehicles. Rates crashed to their lowest in over a decade in 2021 and the global fleet of car carriers saw no growth between the period of 2016 and 2022. Finally, in 2022 the world started to open up, cars started being shipped, rates started climbing again, and they did not stop. Charter rates have essentially tripled since January 2022 as supply has not kept up with demand while Chinese EV makers have been aggressively exporting, becoming the largest vehicle exporter in the world. Naturally the order book for car carriers has picked up, however rates are likely to stay elevated for a few reasons.

First, we are currently coming off an incredibly strong containership and tanker market that has seen shipyards filled with orders for those types of ships. Additionally, even shipyards with space are facing delays and slow build times due to lack of expertise in such a niche type of vessel, especially in China which has historically not been a large exporter of vehicles. More importantly, China has made it a strategic priority to dominate the global EV market. Demand growth for car spaces is expected to keep pace with new builds at least for the next 2 years as Chinese EV exports grow, fueled by government subsidies lowering the cost of production and making prices more attractive. The pushback I’ve heard to this is “what about the tariffs on Chinese vehicles both Trump and Biden have promised to enact, won’t that hurt demand? Currently according to Gram Car Carriers there are “no significant Chinese exports to the US market” which means that the tariffs, while possibly limiting demand growth, aren’t going to hurt total demand. Vehicle shipments to the US can only grow from here regardless of tariffs. All this in mind, this is where we get to Singapore Shipping, which stands to benefit hugely if rates remain remotely close to where they currently stand.

Singapore Shipping owns a fleet of 5 car carriers which it leases out on long term (>10 year) charters. These long term leases sacrifice short term exposure to spot rates for consistent, reliable profitability. The companies last lease renewal was in 2015, with all of their ships having renewed their leases between 2010 and 2015 (when rates were very poor) and as a result they haven’t benefited from the huge climb in PCTC rates at all. However, the company has 2 ships coming up for lease renewal in the next few years which could potentially have a huge impact on earnings if rates are still elevated.

It gets a little hazy here as the company doesn’t provide detail on its lease specifications however some of the older annual reports have more detail, and other information can be pieced together using the financials. The first ship to be renewed is the Boheme, their oldest but largest ship currently being leased at a day rate of around $21,000. To put this in perspective, 1 year rates for 6500 ceu (car equivalent unit) ships currently stand at $115,000, with 5000 ceu at $95,000. The Boheme will be renewed around mid to late 2025 and will be 26 years old at that point, making a 5 year extension reasonable. Gram Car Carrier’s 17 year old, 7000 ceu “Viking Queen” was renewed for 5 years in the last quarter for a day rate of $62,300. While I don’t have a specific prediction, analysts expect rates to remain strong through 2025 due to the reasons listed prior, meaning that they will likely be renewing at significant increase to their current rates.

Their next ship to come off is the Sirius Leader, a 24 year old, 5000 ceu ship coming off lease in late 2026. Admittedly, this one is more speculative, as significantly more supply will likely have come online by then. However, as shown in the earlier chart from Gram Car Carriers, excess vessels are not expected until 2027. As the Sirius leader is currently on a $10,000 day rate (essentially trough rates), any continued strength in the PCTC market will result in a significant improvement in profitability for this renewal.

The other three vessels likely don’t come off contract until 2030 (assuming 15 year contracts, I couldn’t find their lease length’s anywhere). They consist of two 20 year old, 6500 ceu carriers and the crown jewel Taurus Leader, a 9 year old, 7000 ceu carrier. I assume the 20 year old carriers will likely be renewed for an extra 5 years in 2030 similarly, while I‘m unsure what they’ll do with the Taurus leader. At an average day rate of $17,000 between the three of them they are still at essentially trough rates, with lower rates for equivalent sized ships only being seen during Covid in the past two decades.

While obviously I don’t know what rates they’ll renew these leases, I want to run some quick maths with some conservative assumptions. I think that $50,000 for 5 years would be fair base assumptions for the Boheme, as I do believe rates will remain strong through 2025. I believe $17,000 would be a reasonable expectation for the Sirius Leader, which would represent roughly normal rates over the past decade. Additionally, I’m assuming their ship services segment plus all expenses grow at 4% over that time for inflation. Obviously, these numbers are extremely rough, but I just wanted to demonstrate the kind of operating leverage in play here.

After doing $13m of FCF in 2025, that jumps up to $25m in 2026 (at a current market cap of $72m) after the Boheme is renewed. Assuming the Sirius Leader is also renewed at a reasonable rate, the company should basically do $25m a year in cash flow until 2030. At this point they will still have two ships with around 5 years left and a huge 7000 ceu with another 15 years left in it. There’s too much variability for me to do a specific valuation, but this is an attractive setup for me.

Additionally, looking at the balance sheet there’s a huge margin of safety. The company has taken advanced payment for many of the lease contracts as reflected by cash offsetting unearned revenue. The company currently has $74m of cash, receivables and securities offsetting $65m of total liabilities comprising mainly unearned revenue and bank borrowings. The company essentially has no debt and due to the positive working capital cycle is able to earn interest on that cash that hasn’t been booked as revenue yet.

A key question here is around capital allocation, an especially pressing question for an emerging market, insider run, microcap shitco shipping stock. It’s quite possibly the worst combination of traits you could find in the investing universe. Management has a surprisingly decent track record of capital allocation. The company sold 10 ships at peak prices back in 2007-2008, distributing large dividends to shareholders before purchasing new ships at attractive prices through the early 2010’s with rates in a trough. It’s not unreasonable to expect they may do the same here with the two ships on expiring leases. At the very least they have a history of returning capital to shareholders and well timed purchases.

Finally, I want to discuss management a bit further. This company first popped onto my radar due to a combination of share repurchases and constant insider purchases, always an attractive sign. However, Chairman C K Ow doesn’t have a fantastic track record with minority shareholders. At Stamford Land Corp, insiders were granted priority allocation to excess rights in a rights offering, resulting in a $2m fine from the SGX. Additionally, following a dividend cut and questions around executive remuneration and competency, Stamford Land Corp sued a minority shareholder for defamation. These aren’t the actions of someone who has the interests of minority shareholders in mind and is a key risk in this situation.

In spite of this I do view Singapore Shipping to be extremely attractive. A core question I like to ask in all my ideas is “why is it so cheap?” This one is extremely easy to answer. Not only is it on the underfollowed and out of favour Singapore exchange, but it also screens extremely poorly. Only with a reasonable amount of effort would one be able to understand the major catalysts the company has in the near future. Depending on how strong rates stay the company has significant upside, while I feel like the risk of significant capital impairment is extremely low. This feels like a situation with asymmetric upside and I have made it my second largest position at the time of writing.

Before I finish up I just want to thank everyone who’s been reading my writings and especially anyone who provides me with feedback of any kind. In the past year I’ve managed to really cultivate a little investing community following me that has been an incredible source of knowledge and ideas. I feel as though I have come so far in the past few years of doing this and anybody who has ever interacted with me has contributed to that growth and improvement. I haven’t had a lot of time for investing in the past few months due to a secret personal project (all positive don’t worry), and I will likely be going dark for a couple of months as it wraps up, but later this year I will be back with new ideas and great investing discussions. I appreciate you all.

Those who have followed the finblogs for a long time might remember: http://quinzedix.blogspot.com/2015/11/singapore-shipping-corporation-pure-car.html?m=1

"The company has taken advanced payment for many of the lease contracts .. unearned payments"

This is explained by chairman C.K. Ow in ar2016, see page 5, Charman's Message - financial performance. https://singaporeshipping.listedcompany.com/misc/ar2016/ar2016.pdf

During a lease period the company receives variing payments dependent on the age of the ships. For booking purposes these non linear payments are transformed to linear payments over the full lease period .