Merchant House International: Throwing in the Towel

Hello readers, I’m back from my hiatus with a short, simple idea that feels like a classic, tiny, crappy, illiquid, international ‘Myles’ deep value special. I’m returning to the exchange of my home country of Australia for this one. In a messy macro environment and a frothy market, I’ve found both comfort and success in small, mispriced asset liquidation plays. These sorts of ideas (such as Cardno, DNA2 and GABI) appeal to me as they don’t require a long term view of the economy and don’t require you to take a contrarian view on the business against the market. Instead, these sorts of companies are often mispriced due to having no natural buyer and a tired shareholder base. These sorts of plays often only require simple asset valuation assumptions along with a management team working in shareholders best interest and can provide clear margins of safety which can create a beautiful heads I win, tails I don’t lose much scenarios for a great risk/reward ratio.

The company I’m focusing on is China based, ASX listed Merchant House International ($MHI.AX), a textile manufacturer operating out of both the US and China. The company has a long track record of profitable dividend paying going back to 1995, however has come onto hard times with China's weakening manufacturing dominance and the US’ inability to compete with developing markets, before the killing blow of covid sealed their fate. The company has been selling off assets to survive, however seems to have finally thrown in the towel and recently announced that they would liquidate. I’m not going to go into too much detail of the history of the company, other than to note that unlike most ASX listed China shitco’s Loretta Lee (founder and chairperson) seems to have a reasonable track record. The company thrived during the 2000’s and early 2010’s, resulting in a reasonable 5% annual total return since 1994 in spite of the recent struggles. Additionally, as the majority shareholder, Lee is strongly incentivised to extract as much value as possible in this liquidation. My point here is not to portray Lee as some magical value creator, but just to illustrate that I believe she will likely work aligned with investors' best interests.

Over the past few years the company has been selling off assets to try and streamline operations and cover operating losses. While they have been unprofitable, MHI owns all of their manufacturing facilities, which they’ve been able to monetise so far with the $28m sale of Carsan in 2021, the recent $8.3m sale of Tianjin leather and other smaller sales. The stock price for MHI recently jumped 180% as they announced that they would sell their last factory (a Virginia based towel manufacturer) and liquidate the company, confirming that the remaining value in the business would be monetised and returned to shareholders . In March the company had $2.2m cash and net receivables and since sold their stake in Tianjin for $8.3m. In the June cash flow summary (Australian companies don’t report full financial statements quarterly) the company had around $2.5m expenses on $1.7m revenue, which we can extend out a further quarter for $1.5m of further cash burn to put us at around $9m of current cash and receivables.

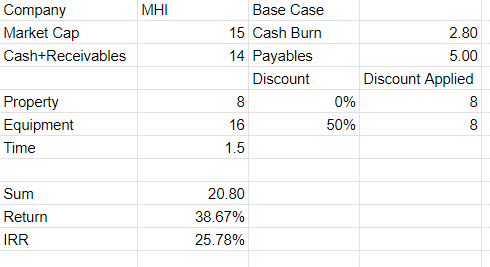

The quarterly report details their expenses by segment. Assuming AMI expenses drop to <$100k total cash burn will stay at <700k a quarter even if corporate overheads don’t drop. The big question here is around the remaining property, plant and equipment. MHI owns a towel manufacturing plant at 750 Old Abington Highway, Bristol, Virginia which is marked at $8.6m for the building and $16.4m for the equipment. At a 16c share price the company has a market cap of $15m. Assuming a reasonably timed wind up and assets being sold for remotely close to their carrying value it’s very easy to see a very attractive potential irr here.

I want to go through my base case for the liquidation. I have no special insight here into the value of their property and equipment so will be using some pretty conservative assumptions. My base case involves selling the property at book value (which may be an underestimation due to the company not revaluing the property). Meanwhile I think it’s fair to mark down the equipment by 50% as I have no idea how valuable it will be upon resale. These assumptions, and a conservative 1.5 year liquidation period gets us to a nice 39% total return and a 26% irr. In reality I believe that there is potential for upside in every assumption, with the cash burn, timeframe and PP&E valuations all being on the lower end. It’s important to note that the company has a history of getting reasonable prices on their previous disposals. As a loose base case I believe that this is very attractive.

A question I like to ask myself about attractive investment ideas is “why does this opportunity exist”. In this situation the answer is fairly straightforward. MHI is a loss making, Chinese nanocap. Most investors would never take a second look if it popped up on their screens. In reality, the cash and property on the books provides stable downside protection, while leaving a lot of upside if the liquidation goes well. At time of writing I currently have a 5% position with a cost basis of 14c and may look to add more.